If you're importing gloves from China, understanding the tariff system can save you a lot of hassle and costs. Tariffs can significantly affect the final price of your products, especially in the case of high-volume imports. Are you ready to get clear on how much extra you'll need to pay?

The tariff on Chinese gloves varies depending on the material and type, but typically ranges from 0% to 25% or higher. Understanding the HS code system will help you determine the exact tariff for your specific gloves.

Tariffs are often a source of confusion for international buyers, especially when it comes to specialized products like gloves. Understanding the classification of gloves under the Harmonized System (HS) and knowing how tariffs apply can ensure that your business remains competitive while avoiding unnecessary costs.

[Table of contents]

What is the HS code for gloves in China?

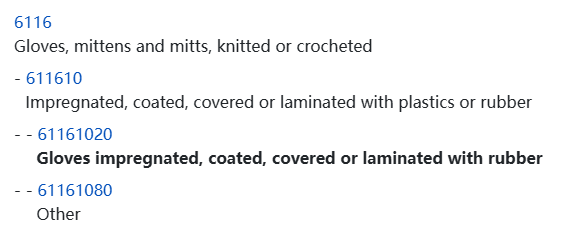

When you import gloves from China, the Harmonized System (HS) code helps classify products for customs clearance. It’s crucial for determining the tariff rate. But which code applies to your gloves?

The HS code for gloves made from various materials like rubber, latex, and textiles usually falls under Chapter 62 or 63 of the HS code, which defines gloves as protective garments.

HS codes: Each type of glove, whether it’s for industrial, medical, or general use, has a unique HS code that corresponds to the specific materials and uses of the product. For example, rubber gloves for medical use have a different HS code than industrial gloves made of leather or fabric. The classification determines both tariff rates and the regulatory requirements for customs.

Common HS Codes for Gloves:

| Type of Glove | HS Code | Tariff Rate |

|---|---|---|

| Rubber Gloves | 4015.19 | 4-25% |

| Leather Gloves | 4203.21 | 0-12% |

| Fabric Gloves | 6116.10 | 2-12% |

| Nitrile Gloves | 4015.11 | 0-25% |

| Safety Gloves | 6116.10 | 0-12% |

What is the tariff on nitrile gloves?

Nitrile gloves are widely used in industrial, medical, and household settings due to their durability and resistance to chemicals. But how much will you pay in tariffs when importing them from China?

The tariff on nitrile gloves can range from 0% to 25%, depending on the exact classification under the Harmonized System. Nitrile gloves may qualify for lower tariffs if they are classified as medical goods.

Nitrile Gloves Tariffs: While most gloves made of rubber or synthetic materials are subject to standard tariff rates, nitrile gloves often benefit from exemptions or lower rates in certain categories, especially if they are intended for medical use. Understanding the distinction between industrial-grade and medical-grade nitrile gloves is essential in determining the applicable tariff.

Factors Influencing Tariff Rates on Nitrile Gloves:

- Material Composition: Pure nitrile or nitrile blends can affect classification.

- End Use: Medical-grade gloves may qualify for exemptions or lower tariffs.

- Country of Origin: Additional tariffs may apply depending on trade agreements or disputes.

What is the HS tariff code for safety gloves?

Safety gloves are another common product subject to tariffs. Since they are used in industries like construction and manufacturing, getting the right HS code for customs can save you money.

Safety gloves usually fall under HS code 6116.10, and the tariff can range from 0% to 12%, depending on the material and use of the gloves.

Safety gloves are often classified separately from standard work gloves because they are designed specifically for protection against hazards like cuts, chemicals, or extreme temperatures. Understanding the classification of your gloves will help ensure you are paying the correct tariff rate.

Safety Gloves: The safety glove category is diverse, with variations like cut-resistant gloves, insulated gloves, and chemical-resistant gloves. Each type of safety glove may have a slightly different HS code or tariff rate based on the materials used and the intended level of protection. Understanding these distinctions is key to calculating your import costs.

Examples of Safety Glove HS Codes:

| Glove Type | HS Code | Tariff Rate |

|---|---|---|

| Cut-Resistant Gloves | 6116.10 | 2-12% |

| Insulated Gloves | 6116.10 | 0-5% |

| Chemical-Resistant Gloves | 6116.10 | 2-12% |

When did the China 25% tariff start?

In recent years, China has faced various tariff hikes due to international trade disputes, particularly with the United States. When did the China 25% tariff on goods like gloves begin, and how has it affected your import costs?

The 25% tariff on certain Chinese goods, including gloves, began in 2018 as part of the U.S.-China trade war. This tariff specifically impacted products under certain HS codes.

Impact of the 25% Tariff: The tariff was initially imposed in stages, starting with a 10% tariff and eventually escalating to 25%. This increase had a significant impact on the cost of importing products from China, including protective gloves. If you import gloves from China, this tariff could have added substantial costs, especially if you’re buying in bulk.

Timeline of the 25% Tariff on Chinese Goods:

- 2018: The U.S. began imposing tariffs on $200 billion worth of Chinese goods, including gloves.

- 2019: The tariff was raised to 25% on some categories, which remained in effect for several years.

- 2021-2022: Ongoing adjustments and trade negotiations continued to impact tariffs.

Conclusion

The tariff on Chinese gloves can vary widely, from 0% to 25%, depending on the material, type, and intended use. Understanding the HS codes and when the tariffs started can help you calculate the true cost of importing gloves from China.